rsu tax rate india

This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised. Tax Implications of Restricted Stock Units.

Restricted Stock Units Rsu Meaning Taxation How It Works Blog By Tickertape

This is true whether were talking about.

. If you keep them for. When an employee sells their ESPP ESOP or RSU once the vesting period is complete and receive their money. Is the top marginal tax rate in India 43 including surcharge etc If not I cant see any case where it would be required.

RSU Withholding Rate A Common Confusion. Here is the information you need to know prior to jumping in. Stock grants often carry restrictions as well.

On this page is a Restricted Stock Unit Projection calculator or RSU calculator. From there the RSU projection tool will model the total economic value of your grant over the years. The Company I work for has its stock listed in US markets.

RSU Tax Rate vs. RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax. Restricted Stock Units RSUs Tax Calculator.

Also Uber should move to a better brokerage. Hi Im a Resident of India working for MNC. This he has exercised as per the vesting schedule and he has been issued certain number of stocks.

Please note that if your RSU income is taxed above 22 when your taxes are filed depending on your other tax withholdings you. Thus the RSU above attracts tax two times. On etrade we have option to sell only ESPP or only RSU.

For STCG where the securities transaction tax is applicable the applicable tax rate is 15 surcharge and health and education cess. On calculating this comes up to an effective rate of 411 percent rate Rs 30 tax on every Rs 100 earned plus another 37 percent on Rs 30 which is Rs 111. Answer 1 of 5.

The terms qualified and. You need to pay the difference of tax rate in India and US. For Taxes to be paid in India.

Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent. RSUs are NOT grants of restricted stock. RSU taxation in India.

An individual who is an employee of a Company in India has been given RSU and ESPP of a Foreign Company USA during 2016-17. I have signed w8ben treaty through by trading partner account to avoid double taxation. The companies many a times sell certain portion of such shares after vesting to pay the tax on such vesting.

The beauty of RSUs is in the simplicity of the way they get taxed. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock. When the RSU vest with the employee he need to include it in his salary income as perquisite and pay tax on same.

The capital gains tax rate when you sell the shares you own. As the name implies RSUs have rules as to when they can be sold. Enter details of your most recent RSU grant your companys vesting schedule and some assumptions about your tax rate and your employers future returns.

The ordinary earned income tax rate when the RSUs vest or. 1 At the time of vesting and 2 At the time of sale. Here is an article on employee stock options.

The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent for the exceeding part. I have RSU as part of my compensation. Wow that is quite bad.

Taxes to be paid in India and stocks listed on foreign exchanges. There is a lot of confusion around Restricted Stock Units. The loss from the sale of shares can be carried forward up to 5 years.

RSUs can also be subject to capital. For 2021 that rate is 22 on supplemental wages up to 1 million and 37 for wages in excess of 1 million. In fact there are only two rules viz.

Now that you know the basics of how RSUs work you can now confidently use the RSU Tax Calculator Below. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. So you have to pay tax on all Rs 1 lac however if its RSU of a public listed Indian company your tax will be NIL because of long term capital gains but if its a out side india listed company then 20 of 1 lac which is Rs 20000.

Further cess at rate of 4 is levied and the total tax rate comes up to 427 percent. 20 ESPP shares vested on 1 Jan 2017 20 RSU vested on 30 Mar 2017 20 ESPP shares vested on 30June 2017 20 RSU vested on 30 Oct 2017. Even Google has support for fractional shares now like in your example they sell exactly 215 shares and not 3.

It will be taxed as short term capital gains. Restricted stock units RSUs and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers.

May 6 2021 Author bio Ryan McInnis founded Picnic Tax after working for more than a decade at some of the financial services industrys leading firms. Its important to remember that the RSU tax rate will be the same as your income tax rates. At the time of vesting.

Tax treatment of RSUs in India The RSU perquisite is taxable based on the period of stay during the vesting period and resident status at the time of the grant of option. This year when my RSU stocks vested stocks were sold to cover taxes. On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers.

RSU are offered to many employees these are common and in most of the cases the amount is transferred to indian Bank Account. How your stock grant is delivered to you and whether or not it is vested are the key factors. Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide.

They are grants that are valued in company stock but for which no stock is actually issued until they vest. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. When preparing taxes in 2021 her actual tax due from RSUs is 37000 37 ordinary income tax rate 100000 Tax surprise - Since funds from her RSUs redemptions were withheld at the 22 supplemental rate she has to come up with an additional 15000 out-of-pocket to pay her taxes due on April 15th.

Now when i sell 40 ESPP share on 1Nov 2017. Unlike the much more complicated ESPP they get taxed the same way as your income. Should i pay tax on 40 ESPP or 20 ESPP and 20RSU.

RSU Taxes Explained. Youll be taxed at the short-term capital gains tax rate if you keep your shares for less than a year. How Are Restricted Stock Units RSUs Taxed.

RSU Tax Rate.

Tax In India On Income Earned From Rsu Vested In Foreign Countries And Exemption From Such Income Taxontips

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Income Tax Implications And Reporting For Rsus Espps R Indiainvestments

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Rsu Espp And Esop Understanding Meaning And Taxation

Rsu Of Mnc Perquisite Tax Capital Gains Itr

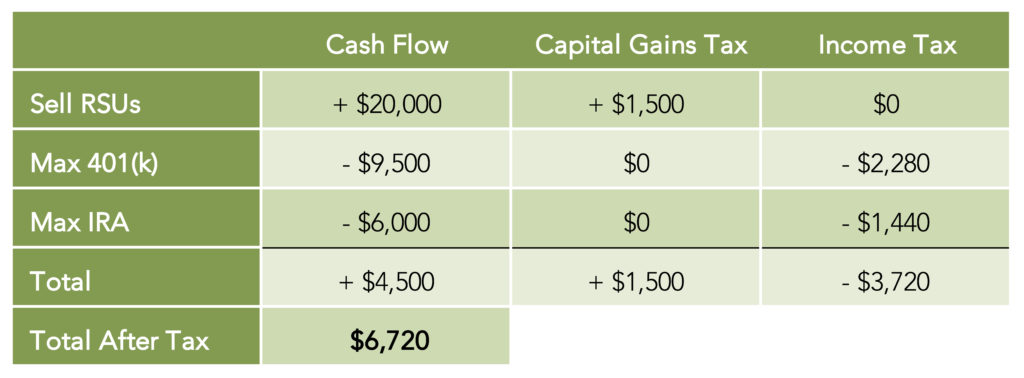

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Understanding Rsu Esops Espp Tax Implications Mymoneysage Blog

How Are Esops Rsus Taxed In India Aditi Bhardwaj Co

How Are Foreign Shares And Rsus Taxed In India Youtube

Relooking Esop Taxation The Hindu Businessline