cayman islands tax calculator

The British Virgin Islands for example has no corporate tax estate tax inheritance tax gift tax or sales tax and it has an effective income tax. Cayman Islands Non-Residents Income Tax Tables in 2021.

Taxes In Montenegro In 2022 Updates For Expats Internationalwealth Info

Individual - Taxes on personal income.

. The calculator is designed to be used online with mobile desktop and tablet devices. Could anyone help. Cayman Islands Annual Salary After Tax Calculator 2019.

Cayman Islands Residents Income Tax Tables in 2021. Salaries are different between men and women. 75 of consideration of Market Value whichever is higher.

The Annual Wage Calculator is updated with the latest income tax rates in Cayman Islands for 2022 and is a great calculator for working out your income tax and salary after tax based on a Annual income. Cayman Islands Customs Agency CICA 39 Ashco Street. 1 345 949 2350 mail Email link Web.

All areas within the Cayman Islands including Cayman Brac and Little Cayman. I have a couple of Cayman Islands company codes that require a tax procedure. Importance of Global Cross-Border Economic Activities.

Cayman Islands Annual Salary After Tax Calculator 2022. We will put the content up when we receive enough interest. How much does it cost to Travel the Cayman Islands.

Flat rate on all taxable income. Up to 128 cash back Things To Know When Shipping To Cayman Islands. Like many islands in the Caribbean the Cayman Islands served as a minor offshore pirate sanctuary as early as the 18th Century a tradition that is now celebrated annually8 Yet it was not until the middle of the last century that the first seeds of the modern tax haven or secrecy jurisdiction were sown.

Here you will find a variety of luxury beach resorts and many scuba diving snorkeling sights. There are no income or withholding taxes imposed on individuals in the Cayman Islands. This is a placeholder for the tax calculator for the Cayman Islands.

The tax duty threshold is the amount at which a person begins paying taxes based on the declared value of an item. The calculator is designed to be used online with mobile desktop and tablet devices. The Cayman Islands derives a significant portion of their revenue from the collection of duties and people are expected to be completely honest when they declare their overseas purchases.

There appears to be no SAP standard calculation procedure for the Cayman Islands. Verification of sea service upon request from a seafarer who has served on a Cayman Islands ship Processing of an application for a Seamans Discharge Book or other seafarers document Assessment of application for an Endorsement or License Recognizing a Certificate as valid for service on a Cayman Islands ship and the issuance of an. The Annual Wage Calculator is updated with the latest income tax rates in Cayman Islands for 2019 and is a great calculator for working out your income tax and salary after tax based on a Annual income.

Without duties the alternative may well be income tax and that would be a far worse burden to bear. The Cayman Islands are not just a tax haven the are a true paradise worth visiting. The Tax tables below include the tax rates thresholds and allowances included in the Cayman Islands Tax Calculator 2021.

Up to 128 cash back Cayman Islands Import Tax Custom Fees. Email arcaymanislandsky or call 949-0623 if you have any queries regarding 2022 Tourism Accommodation Taxes. Print Individual Tax Summary.

Are Tourist Accommodation Taxes TAT and Time Share Taxes TST due given that there are limited tourists in the Cayman Islands. The duty and tax calculation for your shipment is as follows. No TAT have been waived for the 2021 year expiring on December 31 2021.

While individuals might create shell companies in tax havens to hide their wealth corporations are usually directly incorporated in the tax haven in order to defer taxes. Duties and Taxes Calculator. Taxes are however imposed on most goods imported to the Islands and stamp duty especially on direct and indirect transfers of Cayman Islands real estate is a significant head of taxation in the Cayman Islands.

Individual - Significant developments. Men receive an average salary of 63979 KYD. First Time Caymanian Purchasers For bare land purchasers up to CI100000 in value providing an owner occupied house is to be constructed.

If youd like a copy of it please contact us. Tax Calculator Cayman Islands. Cayman Brac is a popular launching pad for.

The Weekly Wage Calculator is updated with the latest income tax rates in Cayman Islands for 2022 and is a great calculator for working out your income tax and salary after tax based on a Weekly income. 0 of consideration of Market Value whichever is higher. This overseas British Territory consist of three islands of which Grand Cayman is the largest.

When shipping a package internationally from United States your shipment may be subject to a custom duty and import taxEvery country is different and to ship to Cayman Islands you. Use this calculator to estimate import duties and taxes for hundreds of countries worldwide. All data are based on 3 salary surveys.

Loyalty Click to learn more about our services. Review the full instructions for using the Cayman Islands Salary After Tax Calculators. The most typical earning is 55887 KYD.

Average salary for Tax Accountant Cayman Islands is 63012 KYD per year. Services include twice a week ocean consolidations and cargo clearance daily air shipment handling and many others from Miami to Cayman. Print Corporate Tax Summary.

Cayman Islands tax calculation procedure. The calculator is designed to be used online with mobile desktop and tablet devices. Cayman imposes no income capital gains payroll or other direct taxation on corporations or individuals resident in the Cayman Islands.

Income Tax Rates and Thresholds Annual Tax Rate. Cayman Islands calculates using the CIF method which means the. The taxation for a particular country depends on the local GSTVAT as well as the item category and its declared value.

It will calculate Caymanian Income Tax and wage taxes. The cayman islands is the third worst tax haven for corporate tax avoidance and the worlds worst tax haven in terms of financial secrecy according to the tax justice network. The Cayman Islands Tax Neutral regime is a globally responsible tax model that is simple and transparent and efficiently supports the global free flow of investment capital and financing without posing tax harm to other countries tax bases.

How To Calculate Foreigner S Income Tax In China China Admissions

Budget 2022 Income Tax Calculator Assumptions Kpmg Ireland

Prosedur Yang Disepakati Agreed Upon Procedures Rsm Indonesia

How To Calculate Foreigner S Income Tax In China China Admissions

Guide To Corporate Tax In Vietnam For Foreigners

Cayman Islands All Areas Cost Of Living

8 Best Tax Haven Countries To Open An Offshore Bank Account Goodreturns

Czech Salary Income And Maternity Stay Calculator Pragueexpats

Us Taxes For Expats In The Cayman Islands

Germany Taxing Wages 2021 Oecd Ilibrary

Psak 74 Insurance Contracts Kpmg Indonesia

The Cayman Islands A Tax Haven Country No Tax On Properties

Czech Salary Income And Maternity Stay Calculator Pragueexpats

International Tax Planning Software International Tax Calculator

Cayman Islands Llc Key Features Matters To Be Considered

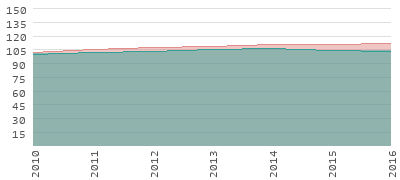

Inflation Rates On The Cayman Islands

Employer Of Record Eor In Cayman Islands Employment Laws Payroll Hiring Peo Cayman Islands